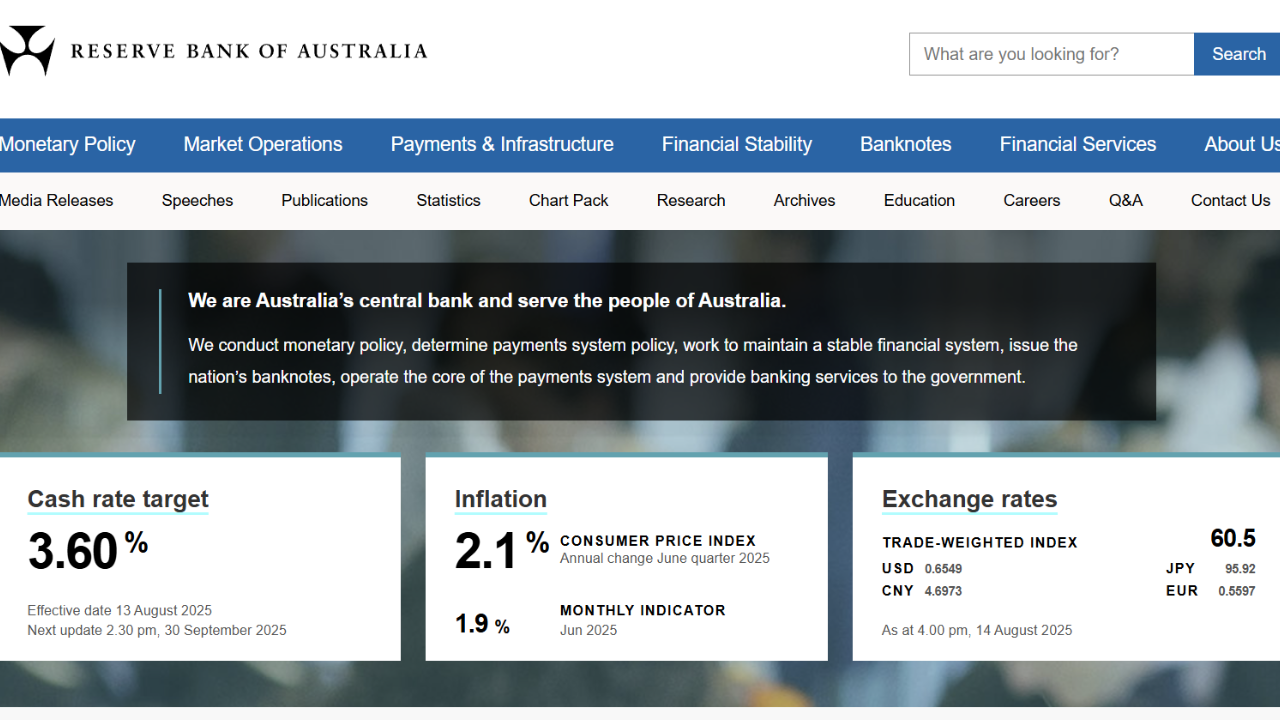

Financial markets have positioned themselves for a Reserve Bank of Australia cash rate reduction this Tuesday, with widespread anticipation of monetary policy easing. However, emerging economic indicators suggest the central bank may exercise caution, presenting Australian businesses with a more complex monetary policy landscape than initially expected.

Market Consensus and Economic Contradictions

Recent polling reveals that 31 of 37 economists forecast a 25 basis point reduction to the cash rate when the RBA announces its decision on July 8. This overwhelming consensus reflects expectations of economic softening and inflation moderation. Yet beneath this surface agreement lies a more nuanced economic reality that challenges the certainty of policy easing.

Official Report Index

RBA Cash Rate Expectations

Inflation Pressures Challenge Rate Cut Narrative

Bank of America analysts present compelling arguments against immediate rate reductions, highlighting persistent inflationary pressures that remain problematic. The trimmed mean inflation gauge, which the RBA monitors closely, is projected to exceed the 2.5% midpoint target in forthcoming quarterly data. This development occurs alongside an unemployment rate that continues below the RBA’s 4.2% estimate, demonstrating ongoing labour market tightness.

Inflation Indicators vs RBA Targets

Unit labour costs remain elevated, driven by persistently weak productivity growth. This dynamic creates upside risks to inflation, even as headline price pressures show signs of easing. The combination of these elements presents a complex economic environment where traditional rate cut justifications may not apply.

Economic Indicators Summary

Our Advice

ACCI recommends businesses prepare for multiple scenarios rather than banking on anticipated rate reductions. The economic data suggests the RBA may pause to reassess before loosening policy, given lingering inflation risks and labour market dynamics.

Companies should focus on productivity improvements to address unit labour cost pressures while maintaining flexible financing arrangements. The monetary policy environment remains fluid, requiring adaptive business strategies rather than assumptions based on market consensus alone.

Related Topics

- Major Financial Changes for Australian Businesses: July 1, 2025

- Maximising Tax Deductions: Essential Guide for Australian Workers

- RBA Rate Cut Delivers Financial Relief: Business Community Prepares for Economic Shift

- Urgent Action Required: Family Tax Benefit Recipients Face June 30 Deadline

- Gallagher Seizes Control of Services Australia in Massive Welfare Shake-Up